About the BOC Portfolio

Who we are not.

Business Owners Charter, Inc. (“BOC”) has no assets under management and is not a Registered Investment Advisor, a Broker Dealer, or any entity licensed to sell securities (“Clients”).

Who we are.

BOC is a wholesale investment methodology fiduciary for investment firms.

What we do.

Our wholesale investment methodology offers a potential to provide outperformance of benchmark SPDR S&P 500 ETF Trust (symbol SPY).

Fewer than 20% of actively managed funds beat the S&P 500.

Here are BOCX documented returns.

Why we do this.

You make more. Your clients get better returns. According to Barron’s Top 100 RIA cover story dated 9/15/23, “average team” advisor fees are 0.46% of assets under management, or 46 one hundredths of 1% (“23 million divided by 5 billion”), while BOC Portfolio RIA’s earn about double.

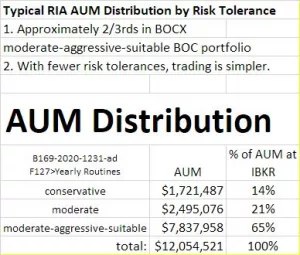

Fewer than 20% of funds beat the S&P 500, far fewer with less risk. The chart below shows our materially higher alpha (returns) and materially lower beta (risk) calculations. Since inception of our BOC Portfolio in 2017 our Total Returns before advisor fees thru 12/31/2024 for the BOCX moderate-aggressive-suitable risk tolerance beat the S&P 500 with less risk.

How we do this.

We seek a repeatable big data methodology through:

- Opportunities worldwide.

- Moderate correlation relative to SPY with less risk and excess returns.

- Active investing including a time consuming market exit strategy.

The BOC Portfolio is created using algorithms and statistics, a process of two strategies overseen by a BOC Portfolio Director.

- First, a List Strategy uses big data to identify an initial ETF List using a proprietary market momentum algorithm. A macro analysis, or context, is derived principally from the stock market.

- Second, the ETF List is reduced using a Filter Strategy. The Filter Strategy is qualitative, searching for fundamental value and momentum within the context. The resulting BOC Portfolio may be substantially different from the initial ETF List.

The context principally from the stock market may opportunistically provide a Market Exit Strategy to reduce beta and increase alpha.

BOC Portfolio methodology contains model portfolios by risk tolerance.

Subscribe to our Newsletter and do it yourself.

Subscribe for one month for $500 or annually $5000 by credit card. Liability is limited to a full refund of annual subscription at any time for any or no reason. Unsubscribe via any newsletter. Auto-pay may be set up by you from your primary checking account.

Actual model portfolios are included by risk tolerance of your choice: conservative, moderate, or BOCX moderate-aggressive-suitable. BOCX moderate-aggressive-suitable seeks potential outperformance of the S&P 500 etf (symbol SPY).

Ready to Subscribe click here.

Disclosure

Our Newsletter is published after trade execution by 3rd party non associated sub advisors. Real time Market Exit Strategies and Special Reports are only available to Newsletter subscribers. See Focio.org for a list of Fiduciary Financial Advisors subscribing to our newsletter. Not all subscribers to our Newsletter need be listed at Focio.org, a public website.

Results

Newsletter reporting of hypothetical Model Portfolios by risk tolerance is incremental in blocks up or down 5%. Viewed this way short term anxiety may gravitate toward interior investor peace of mind. At any point in time see your brokerage account for your actual returns.

BOC Long Term Strategy

BOC Portfolio seeks opportunities worldwide with a potential for a repeatable methodology. When its systematic, computer-powered List Strategy identifies a lack of momentum, it uses benchmark-like investments seeking relative fundamental value; when its algorithms indicate momentum, fundamental value and momentum-based investments are used. Adding an element of conservatism in a portfolio is as important to the BOC Portfolio Director as considering upside potential. The proprietary Market Exit Strategy may employ a special report mitigating risk in down markets. The macro analysis is the context.

Underlying the BOC Portfolio Newsletter methodology is a belief that there may be less risk actively investing in the growing tip of world-wide securities markets than passively investing in under performing asset allocations; in rising markets it seeks to recommend investments in categories of securities with accelerating demand and rising value preferably at the start of their investment life cycles; in falling markets it seeks to preserve capital.

Management Background

Jeffrey Liautaud (MBA, BS Mathematics) began his career on Wall Street in investment banking. Later he purchased and operated the Sherpa Snowshoe Company. When the snowshoe markets changed, Jeff nearly went bankrupt, and in 1998 he sold the business.

This near bankruptcy experience forever changed him to add an element of conservatism in all that he did. That same year Jeff became a Registered Investment Advisor Representative. In 2001, he founded Business Owners Charter, Inc. (“BOC”) for ownership of proprietary investment algorithms.

In 2015, seeking to optimize the BOC algorithms with greater consistency, Jeff was mentored by a Fortune 500 pension consultant and turnaround specialist using alternative investments. The mentor signed a BOC confidentiality agreement and mentored back testing BOC algorithms. BOC applied a rigorous, scientific method-based approach to historically quantify the most promising algorithms and completed a detailed research study.

Dan Wagner, a graduate engineer, and developer, working as an outside vendor executed the actual back test for BOC. The backtest tied out to the mentor’s back test thus giving BOC its first credible self back test capability highly proprietary and confidential to this day.

From 2015 through 2020 Dan Wagner, worked to integrate research findings and was responsible for maintaining and updating the multiple SQL databases used in BOC research while working a full time day job 60 hours per week. Jeff knew Dan as a go-getter and learned that on a trip to New York for his day job Dan was called in to a meeting by his division Sales Manager at a prospective new major bank client. The prospective Credit Card Division Chief of the bank asked Dan : “How can you deliver technology I know is impossible?” Dan replied: “Because I have already delivered the same thing more than 50 times,” and proceeded to explain in detail how he did this for the division Chief’s team involved. At that meeting Dan’s reputation grew as the “go to” person in his day job for technology. His fame spread to Jeff.

In 2021, Dan worked full time including as BOC Portfolio Recommender providing detailed momentum and fundamental investing analysis.

In 2022, the BOC Portfolio Director position was outsourced to Dan Wagner Company.

Dan’s goal is to utilize the proprietary BOC Portfolio methodology as a fiduciary to investment firms like yours. In addition, BOC offers its BOC Portfolio Newsletter to follow the BOC Methodology serving 3 risk tolerances: conservative, moderate and BOCX moderate aggressive suitable.

If interested, call Dan at 708-825-7301 or email Dan@BusinessOwnersCharter.com.

This content is provided by BOC for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. In spite of best efforts, losses may occur.

BOC Mission

- We seek to be a wholesale investment methodology fiduciary for investment firms.

- We seek to determine the expensive investment problems plaguing the financial professional investor market and solve them with small on-going, nuanced improvements.

BOC Values

- We seek to have faith in all those around us; in their good common sense ability to do the next right thing.

- We seek an interdependence based on Spirit-centered community by changing ourselves and no one else. By Spirit we mean a caring presence that exists outside of ourselves.

Returns & Research

Not necessarily indicative of future returns.

About BOC Portfolio

Business Owners Charter, Inc.

6436 N Oketo Ave.

Chicago, IL 60631, United States

dan@businessownerscharter.com

708-825-7301