Summary: There may be 3 parts to a worldwide collapse in all major asset classes. In this investment research paper, Jeff Liautaud considers scenario plans as the collapse occurs. In Part 1, the author explains that if an S&P 500 fall potential exists, being in cash may be the best place to be. In Part 2, the author explains that if a money system risk of default increases, having a token amount in digital currency market leader bitcoin, installing individual transaction capability, not as an investment, but only as a transaction capability, may be a welcome addition. In Part 3, the author explains that after a money system collapse, ultimately stocks may be the best place to be. Corporations seemingly would figure it out.

Part 1 – an S&P 500 fall potential exists

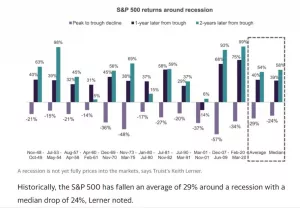

- An S&P 500 stock market drop could be more than an average 29% drop around recession periods found by Yahoo Finance. The S&P 500 peak drop at market close year to date was about -26%. Since then, the market loss has been reduced to about -16% as of 12/1/2022.

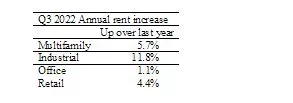

- The US economy was still growing in Q3 2022. By definition inflation quelling can only occur by restricting an economy, but no recession has occurred yet.

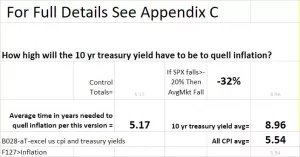

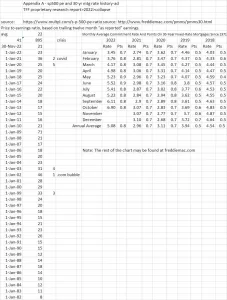

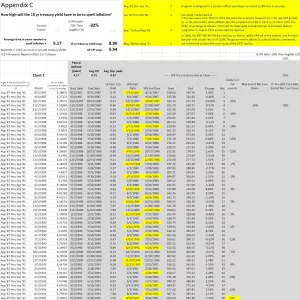

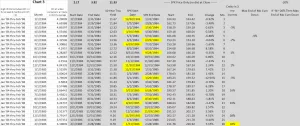

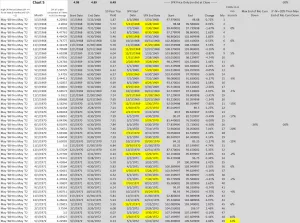

- As shown in BOC’s proprietary research, Appendix C historic inflation on average, was significantly lower than inflation we now have. So, this time it should take longer than in the past to quell current inflation.

- As shown in Appendix C, on average during those historic periods it took over 5.17 years to quell inflation. So, the 2022 stock market recovery may be premature.

- As shown in Appendix C in terms of interest rates, during those historic periods on average the 10–year US Treasury rose to 8.96%, as compared to 12/2/2022 10-year Treasury of 5%. So current interest rates may have to dramatically increase, which may draw money out of the stock market.

- On 11/28/2022 according to Bloomberg, Morgan Stanley indicates a 70% correlation of S&P500 price to printed currency, Bank of America indicates 50% correlation, and Leuthold investments uses their own 14 monetary/liquidity indicators, all but one of which are rated negative. Their indicators “imply there’s no longer enough money to finance production… and to support a stock market that’s still far from cheap,” said Leuthold.

According to Bloomberg on 8/28/2022, the Fed will Quantitatively Tighten at the rate of $95 billion per month (meaning reduce printed currency by $1.1 tn/year… commencing September 2022). According to Morgan Stanley, QT is “the elephant in the room.”

The Fed restriction of the economy occurs through interest rates and QT. The restriction, which has not yet landed, is designed to push down inflation.

Market Exit Strategy

BOC Portfolio’s proprietary 26 Factor Macro Analysis gets signals principally from the market itself. When the stock market may appear overvalued, a Stock Market Exit Strategy may be employed.

In Part 2, we explain that if a money system risk of default increases, having a token amount in digital currency market leader bitcoin, installing individual transaction capability, not as an investment, but only as a transaction capability, may be a welcome addition.

Bitcoin Hypothesis: If accelerating devaluation of the US Dollar is expected, Bitcoin may be an alternative to devaluation of the US Dollar.

A regulation risk of largely unstated regulation that exists is being bypassed by merchants who have already integrated digital currencies in their finance functionality. Should you choose to own Bitcoin individually, you acknowledge and accept that such an unstated regulation risk exists and accept that risk solely as your responsibility. By reading this research report you acknowledge that you will comply with all applicable local, state, national and international laws, rules and regulations.

When the restriction of the economy lands, a significant devaluation potential of all high-priced assets may occur. Such assets include real estate, stocks, bonds, and the fiat currency itself, namely the US Dollar, none of which are yet cheap.

Inflated Assets

The Spend Agenda is popular among politicians because it may be executed without taxation by printing currency and provide a wealth effect. The “wealth effect” is the notion that when households become richer as a result of a rise in asset values, they spend more and stimulate the broader economy.

The Spend Agenda

BOC coined the phrase Spend Agenda to depict a lack of balance in Monetary Policy and Fiscal Policy combined. Monetary policy refers to the actions of the Fed to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth. Fiscal policy refers to the tax and spending policies of the federal government.

The Spend Agenda lack of balance 22-year excess may be seen in Fiscal Policy of deficit spending every year through the date of this report. In 2008, another unhealthy curve in the road began with Quantitative Easing or printing currency to fuel the Politicians’ ever increasing Spend Agenda. Such combined Spend Agenda policy was as excessive as the wealth effect it produced:

- The Spend Agenda rests on the false assumption that there is no upper limit to printed currency. At current levels of US National Debt, the only way that our currency may remain afloat may be by printing more currency since that is what has been done in the past.

- In the Spend Agenda Era whichever party is in office that party carries out its own Spend Agenda.

- Most amazingly, politicians avoid the ire of taxpayers being charged a tax bill by printing currency and growing the US National debt.

- Printing currency and increasing US National Debt in reality has falsely passed as a substitute for taxation because of the wealth effect.

Other Sovereigns follow suit thus increasing Spend Agenda risk worldwide.

The US Dollar-led fiat currency Spend Agenda path has been followed by fiat currencies around the world. Therefore, the collapse potential may be a worldwide money system collapse.

- New increased sovereign debt default risk is occurring for both advanced and low-income countries. On 10/1/2022, Barron’s published an article titled The U.K. Is Buying Bonds Again. Why That’s Setting Off Global Alarm Bells. From the article:

“The Bank of England this past week entered the market for British government bonds, or gilts, to purchase 65 billion pounds of the securities to stanch a meltdown in the market. That marked a stunning reversal from its policy of reducing its bond holdings, a process dubbed quantitative tightening, which is being followed by most of its counterparts, notably the Federal Reserve and European Central Bank.”

The article’s significant indication is that a potential collapse of a money system may be a forced reversal to printing currency like England at a time when official English policy was the opposite, quantitative tightening.

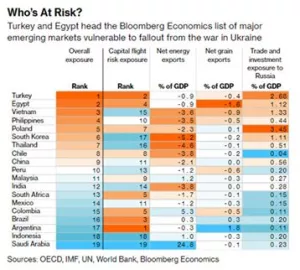

- On 4/20/2022, Bloomberg identified significant debt default risk in 19 specific low-income countries.

A Treasury Liquidity Problem May Exist.

On 10/6/2022, Bloomberg published an article titled: Treasuries Liquidity Problem Exposes Fed to ‘Biggest Nightmare’ which said in part:

- It’s getting harder and harder to buy and sell Treasuries in large quantities without those trades moving the market.

- “We have seen an appreciable and troubling deterioration in Treasury market liquidity,” said Krishna Guha, head of central bank strategy at Evercore ISI.

- “The biggest nightmare for the Fed now is that they have to step in and buy debt,” said Priya Misra at TD Securities.

Money System Collapse Potential

In summary of the above, the US fiat currency problem is this. Banks lock up Treasuries, which reduces liquidity, leaving the Fed alone to backstop Treasury market liquidity. If the money isn’t there, the only option may be for the Fed to print more currency. To the degree that the world does not accept the Fed printing more currency, may be the degree to which the worldwide money system collapse potential exists.

- “At a precarious moment, the world is awash in sovereign debt,” said the Minneapolis Fed 11/10/2022. “High debt and rising rates can restrict economic policy of developed economies and drive low-income countries into default with no clear safety net,” they said.

- Having a backdoor capability to transact in Bitcoin could offer potential protection from a money system collapse.

- Initial Spend Agenda protection may come from a minimal amount being in Bitcoin, digital currency market leader, installing individual capability, not as an investment, but only as a capability.

The War in Ukraine

According to Reuters on 9/21/2022 Prime Minister Modi of India said to Putin “Now is not the time for war.”

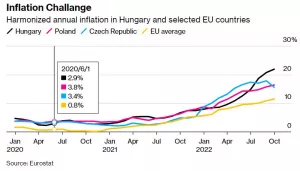

For countries who import both wheat and energy, the impacts of the war on inflation and consumer prices may be particularly severe.

Default Risk

With 2022 CPI inflation at 7.7%, who would buy 10-year Treasuries 11/30/2022 at interest rates of 3.7%, or 30 year Treasuries at interest rates of 3.8%? So few as to be inconsequential. So, the Treasury must turn to short term maturities.

A Treasury Funding Dilemma May Exist

Demand exists for short term Treasuries under 1 year maturity under a scenario of stable long term rates. If the long term trajectory is perceived as higher rates, some demand for short term debt may dry up.

According to Reuters Bond Investors Go For Safety an article dated 5/2/2022, the US Federal Reserve ultra-rate hikes are

“prompting bond investors to seek safety by adjusting the duration of their portfolios…” ‘The simplest and lowest-risk solution is simply to reduce or eliminate duration risk,’ said John Lynch, chief investment officer at Comerica Wealth Management.”

That largely means cash or money market funds. Some demand for short term Treasury debt offerings may dry up in a dead zone. Until some point in time when interest rates have gone up enough, a Treasury funding dilemma may exist in the dead zone.

It may be better to stay in cash and wait until long term Treasuries are perceived as worth buying. Long term Treasuries may be in a dead zone for the same reason. Buying long term Treasuries in a rising rate scenario would be a losing proposition, until it is perceived that rates have stabilized again.

The entire Treasury funding dilemma may be in a dead zone, until some point in time when 10-year interest rates have gone up enough to say Appendix C levels of 9%.

A time may come when no one will want long term Treasuries to the degree that fear of devaluation increases. If the dead zone creates a funding dilemma for financing the US National Debt, rather than default, the Fed would print currency, meaning, the Fed would buy even more Treasuries. A trigger point may occur when the Fed has no alternative except to print currency again. And if enough low income economies default, at what point do the rate hikes stop?

Money Model – a Race Against Time.

The dead zone may cause a Treasury funding dilemma, and the Fed may have to print currency, or if Chairman Powell is successful at Quantitative Tightening (removing printed currency), then the dead zone may occur from deficit spending.

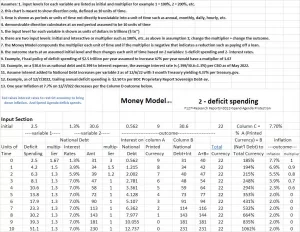

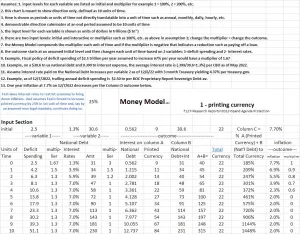

There are two Money Models of the dead zone shown below: 1) printing currency and 2) deficit spending.

Money Model 1 – Printing Currency

Note: In the Money Model above, inflation is controlled as seen in Column D. But Column C % of printed currency plus US National Debt to total currency rises to ridiculous levels.

Money Model 2 – Deficit Spending

Again Column C % of printed currency plus US National Debt to total currency rises to alarming multiples M3 Total US World currency levels.

What comprises the latest Spend Agenda to name a few? “The Chips and Science Act, Inflation Reduction Act, and Infrastructure Investment and Jobs Act could bring some $270 billion in spending estimates” according to Melius Research. But the question at this time is whether a budget surplus is needed more to help the Fed quell inflation, than a budget deficit.

“All in” Money Model.

In the “All in” Money Model, Bitcoin serves as the host currency. The main problem of Bitcoin at the present time is its stable value around $16,000 to $20,000 from about May of 2022 thru about December of 2022.

Bitcoin never will go down if it replaces the US Dollar as the world’s new reserve currency, but the exchange ratio of 1 Bitcoin to fiat US Dollar currency can only go up. By this I mean US Dollars in bucket loads will exchange for 1 Bitcoin. How can I be so bold as to predict that? Because Bitcoin has no Spend Agenda.

The Spend Agenda is the true scourge of humanity. My Bitcoin has no such scourge.

The Bitcoin Alternative

According to Deloitte

- Download the PDF: Digital currency payments and merchant adoption survey conducted by Deloitte titled “Merchants getting ready for crypto.”

- A US Dollar alternative already exists as a digital form of currency according to Deloitte, who polled a sample of 2,000 senior executives at retail organizations across the United States between December 3 and 12/16/2021 published 6/8/2022 and prepared in collaboration with PayPal, US merchants have already moved to acceptance of digital currency as payment.

- “86% see a significant benefit to their finance and cash management for accepting digital currency payments.

- “In fact, 26% have already integrated digital currencies in their finance functionality such as revenue cycle and treasury, and

- “61% plan to do it over the next 24 months.”

- “The survey was published June 8, 2022.

- “More than 85% of the organizations are giving high or very high priority to enabling cryptocurrency payments…”

- “Eighty-nine percent of survey respondents said the complexity of integrating digital currencies with existing financial infrastructures and/or integrating a system across various digital currencies were the leading challenges in enabling these types of payments.”

- “But as this survey has also found, 85% of business leaders believe these challenges are worth embracing since they predict that the use of cryptocurrencies will become even more widespread.”

- “In fact, an overwhelming majority of those who currently accept cryptocurrency as a payment instrument (93%) have already seen a positive impact on their business’s customer metrics, such as customer base growth and brand perception, and they expect this to continue next year…”

Plurality means accepting fiat currency like the US Dollar and digital currency. Plurality at point of sale already exists in digital currency and fiat currency. As use of digital currency rises, use of fiat currency diminishes. The Spend Agenda may be sidestepped by transacting in Bitcoin. To the degree that digital currency bypasses fiat currency, the Spend Agenda may dry up. Having some protection in Bitcoin as market leader of digital currency may be a potential backdoor alternative to the Spend Agenda.

Bitcoin Digital Currency is Pure Scarcity

Bitcoin has no Spend Agenda. Naturally, scarcity may make any asset more valuable. The US Dollar and other fiat (government) currencies are not tied to a hard asset like silver or gold. Governments have the ability to print more money, increasing supply, anytime they need it. Conversely, Bitcoin is an asset that has scarcity built into its design. Bitcoin has a maximum, fixed supply of 21 million Bitcoins.

Bitcoin’s main uniqueness is a total lack of Spend Agenda. Unlike fiat currencies that can proportionately devalue one currency against another undetected, Bitcoin may help detect the fiat currency Spend Agenda. Bitcoin may offer security against a devaluing fiat currency. Having an alternative in place for buying Bitcoin may be worthwhile.

It is not a rise in price of Bitcoin that is sought at this time, but rather a potential backdoor alternative to US Dollar cash. Contagion from a default risk of a run on the US Dollar is more important than price gains. Access to the market leader in digital currency is a first step. Being able to spend wealth is the Spend Agenda Protection. While the price of Bitcoin is flat to lower, converting a minimum amount of an individual’s wealth to Bitcoin permits access to digital currency.

Is the Hypothesis True or False?

Hypothesis: If accelerating devaluation of the US Dollar is expected, Bitcoin may be an alternative to devaluation of the US Dollar.

An accelerating devaluation of the US Dollar is expected. Having an alternative in place for buying Bitcoin may be worthwhile. Because setting up Bitcoin transaction capability takes time. Multisig cold storage self custody, not intermediary custody, open source documentation is complicated but can be done and takes time.

When you get news of a default potential, it may already be too late to move. But if you already have a Bitcoin transaction potential, you can still transact.

The hypothesis is true. Bitcoin may be an alternative to devaluation of the US Dollar.

Part 3 – After a money system collapse, ultimately stocks may be the best place to be. Corporations seemingly would figure it out.

Let us compare current valuation to historic prices of real estate, stocks, bonds, and the fiat currency itself, namely the US Dollar.

- Real Estate.

Residential – According to FreddieMac the average annual 30-year mortgage rate over the last 40 years commencing 12/1/1981 and ending 12/1/2021 went from 17.82% down to 2.94% per Appendix A, the lowest in the period. As of 10/31/22 the rate increased to 6.9% but prices are still rising because people with low rates cannot afford to move.

According to Forbes:

“The median existing-home sales price was $379,100 in October (2022), up 6.6% from a year ago.

Commercial – Privately held. According to the National Association of Realtors,

Commercial – Publicly held real estate

As of 11/29/2022 according to Nareit, FTSE Nareit All Real Estate Investment Trusts (“Reits”) year to date fell -22.86%, compared to SP500 fell -15.74%.

Stocks. A stock’s price to earnings ratio (“P/E”) is a measure of value. The higher the P/E the lower the value. According to Multpl.com the 1-year trailing P/E ratio of the SP 500 on 11/30/2022 was estimated at 20. Per Appendix A below the average P/E over a 40-year period commencing 1/1/1982 thru 11/30/2022 is 22, and the average P/E over 150 years according to Multpl.com is 16.

Bonds. According to the St. Louis Fed, since 1981 through 1/2/2022 interest rates have fallen to the lowest rates ever. Now with the Fed hiking rates, bonds lose money. According to Bloomberg on 11/29/2022, the Bloomberg US Treasury Total Return Index in one year has lost about 13%…the worst full year result on record for the gauge since its 1973 inception…The Most Powerful Buyers in Treasuries Are All Bailing at Once.

Commodities. The Dow Jones Commodities Index shows a ten-year peak Index value on 3/7/2022 of 1249 compared to the Index value on 11/30/2012 of 772, up 62% (1249/772-1=62%). On 1/2/2022 the Index was 946, and on 12/6/2022 the Index was 1014, up 7% (1014/946-1 = 7%).

US Dollar. If the Fed were to print currency of $38.8tn (8.4+30.4=38.8), and then dissolve itself, we would about triple US Dollars in circulation. US National Debt at 120% of Gdp. Financial-Stability Risk Rising to Crisis-Like Level, IMF Says.

-

- According to Datalab “Since 2001, the U.S. has experienced a deficit each year.” The US has created a US National Debt of $31 trillion and printed currency of $8 trillion which combined totals $39 trillion. (About $8 Trillion on US Federal Reserve balance sheet of 9/7/22 Mortgage-backed securities $2.7 Trillion plus Treasury securities $5.7 Trillion = about $8 Trillion.)

- The US Dollar currency in the whole world is only $22 trillion. (According to St. Louis Federal Reserve SLF on 7/15/2022, the total amount of US dollars in world circulation, World USD M3 is 21.7 trillion) also roughly confirmed in May 2021 at 19.9tn, see https://money.howstuffworks.com/how-much-money-is-in-the-world.htm.) If the $39 trillion were to be paid off, the US Dollar currency in the whole world would rise from $22 trillion to $61 trillion (31+8+22=61). Tripling world US Dollar currency would be a self-evident devaluation of US Dollar fiat currency.

Part 3 – Observations

The Fed is doing its legally mandated job to fight inflation by increasing interest rates. The Fed era of “lower forever” is over. By increasing interest rates the economy may powerfully contract, especially if the 10-year Treasury interest rate rises to Appendix C 4-period-high-inflation-average of 9%, as compared to 12/2/2022 10-year Treasury of 3.5% .

“The cheap-money era is over for households, businesses and governments. Combining all three, the Institute of International Finance puts the total owed at $290 trillion, up by more than one-third from a decade ago,” said Bloomberg on 11/30/2022 in an article titled The End of Cheap Money.

Historically, major asset classes do not all rise and fall together. According to the Bloomberg article: “The world has added about $80 trillion in debt over the past 10 years.” We posit a hypothesis of a 40% fall in all asset classes together, if the Spend Agenda is withdrawn.

“Blackstone defends BREIT” says Barron’s 12/10/2022. “BREIT is the leading private retail real estate fund,” and is now limiting “redemptions after outsize withdrawal requests.”

Credit Suisse analyst Bill Katz said: “It all works well in a bull market when NAVs are going higher, but when you get into a more volatile environment and investors want to redeem and can’t, it may change behavior for everyone.”

Avoid leverage especially variable rate leverage.

Leverage is a magnification of the impact of earnings due to debt. Leverage has a cost 100% correlated to its interest cost. If all assets fall by 40% or more, leverage can wipe out wealth because losses get magnified.

At first asset values may be frozen in place. Then as some are forced to sell, other asset prices may fall. The wealth effect diminishes as interest rates rise, and may fall when forced spending is valued more than paper valuations.

Cash alone may provide freedom to spend. But to get to cash, liquidations may occur. Contagion may increase market routs. Illiquidity may be a factor as well.

In addition to raising interest rates, since September of 2022, the Fed has been reducing printed currency on its balance sheet at a set rate of $95 billion per month or $1.1 trillion per year. That level per year amounts to 1/80 th of all the debt added over the past 10 years, quantifiably reducing liquidity.

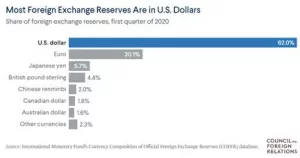

US Politicians are playing Spend Agenda because “The U.S. dollar is by far the most commonly held reserve currency, making up more than 60 percent of global foreign exchange reserves,” according to CFR.org

Reinhart and Rogoff published in March of 2008 a classic research paper titled: “This Time is Different: a Panoramic View of Eight Centuries of Financial Crises.” The authors conclude:

“A recent example of the “this time is different” syndrome is the false belief that domestic debt is a novel feature of the modern financial landscape. We also confirm that crises frequently emanate from the financial centers with transmission through interest rate shocks and commodity price collapses.”

If the only way out is to borrow more, the Fed would be going back on its word, triggering a money system collapse potential.

Seemingly, other central banks have already stopped trying to combat inflation by raising interest rates. According to Bloomberg on 12/10/2022: “Global central banks are pausing or nearing the end of their interest-rate hiking cycles as inflation shows signs of slowing and recession concerns mount.”

Inflation is all over the world. The collapse potential is worldwide.

Part 3 – Possible Scenario Plan

A possible scenario plan might be as follows.

BOC recommends for all risk tolerances 100% in BlackRock Ultra Short-Term Bond ETF (symbol “ICSH”) with a 30 Day SEC Yield as of 8/17/2023 of 5.36%.

ICSH statistics indicate the 384 ultra short term holdings are turned over frequently.

- ICSH seeks to provide current income consistent with preservation of capital, according to BOC estimates with less than 39% in bank names of which 6% were rating downgraded, which is a risk. Paying off short term holdings is the highest priority for a corporation to retain its credit worthiness.

- Effective duration of ultra short term holdings is only 5.28 months actively managed for default risk by Blackrock Professionals.

- $46 million dollars in shares traded per day on average for the last 30 days.

- Expense Ratio: 0.08%

- 30 Day Median Bid/Ask Spread is 0.02%

- Distribution frequency monthly. Record Date: 8/2/23; Ex Date 8/1/23, and Payable Date 8/7/23.

We rely on BlackRock’s cash management team to manage the bank risk portion of the short duration portfolio.

- Ultra short duration bonds from corporate America of 6 months or less tend to avoid long duration bond price risk and disintermediation risk of US Treasuries; yet keep capturing rising yields.

Most importantly, ICSH may avoid disintermediation risk of US Treasuries and may be a better place to hold cash than your bank, brokerage firm or any money market fund holding US Treasuries.

A currency exchange traded fund may be stock market neutral. In a falling stock market being stock market neutral may be a plus. Yet moving from a currency falling in value to a currency rising in value may be difficult.

But some countries and some currencies may break ranks. Of course there is always the Bitcoin digital currency which could compete for currency market share once accepted, but not yet. So be cautious and only establish authenticated self custody transaction capability as your own sovereign.

Today the list of sovereigns with solid reserve fiat currency may be hard to find. Bitcoin has the audacity to make every Bitcoin owner his or her own sovereign in a trust less proof of work.

If all assets fell 40% or more, a money system collapse potential would increase. The only way that the Spend Agenda can increase the wealth effect is by borrowing more. As the Money Model shows, there is an upper limit to printed currency. Current levels of printed currency and deficit spending defy common sense.

Once the decline of 40% or more has occurred, Corporations seemingly would figure it out.

Appendices

Appendix A

Appendix B

Appendix C

End of Special Report

Business Owners Charter, Inc. (“BOC”) and its author is writing this Special Report as an independent third party, not as a securities regulated entity or individual. BOC is a wholesale investment methodology fiduciary for investment firms that alone offer retail securities. Exemption under FINRA rule 2241 is the good of the public interest by seeking to provide objective, contextual truth. Our BOC Special Reports cover matters that superior investing returns may require.

For example, a 2008 Special Report thesis stated: “With respect to the 2008 bailout) the money to fund $1.4tn (trillion) dollars won’t be there, much less $9tn to $16tn dollars. If the money isn’t there and the government still wants its stimulus, the government has no choice except to print currency.”

And as predicted the money really wasn’t there. Printing fiat currency to fund the bailout was present, and was given the name Quantitative Easing.