Summary: Business Owners Charter Inc.’s BOC Portfolio Newsletter asset allocations may change at any time as of 8/17/2023 recommended for all risk tolerances 100% into BlackRock Ultra Short-Term Bond ETF (symbol “ICSH”) with a 30 Day SEC Yield of 5.36%, comprised of Corporate America Bonds. Paying off short term holdings is the highest priority for any Corporation to retain its credit worthiness.

ICSH seeks to provide current income consistent with preservation of capital, according to BOC estimates with less than 39% in bank names of which 6% were rating downgraded, which is a risk.

Effective duration ICSH holdings is only 5.28 months actively managed for default risk by Blackrock Professionals. In a rising interest rate environment, short duration bonds avoid bond price risk of longer duration bonds, yet rise as interest rates rise to combat inflation.

The disintermediation risk of US Treasuries is this. The long term end of the US Treasury debt offering exhibits significant bond price declines. Battling inflation at this time means not knowing how high interest rates must go. This uncertainty causes on going long term bond price declines. This may create a shock of disintermediation risk from a reduction in US Treasuries credit rating.

Let’s read what London based Fitch Ratings said:

Fitch Ratings – London – 01 Aug 2023: Ratings Downgrade.

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Erosion of Governance: In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.

Why equities may fall further.

Yields over 5% with a maturity of 6 months or less, beat inflation of 3%. And during a period beginning 8/1/23 thru 8/18/23 yields over 5% beats the SP 500 (symbol SPY) equity loss of -4%.

Many conservative risk tolerance investors prefer less risk. Yet their broker advised them to go into equities during the low return bond environment of yesteryear. Now these conservative investors are getting out of equities during the period as the equity trading volume is largely consistent, noted below.

Conservative investors rooted in the pre covid era are still experiencing inflation of 18%. The worthlessness of a currency is reflected in its inflation. According to USInflationCalculator.com, $1.00 spent for purchases in March of 2020, in July of 2023 cost $1.18, or inflation of 18%. If the conservative investors anchor is pre Covid, prices in July of 2023 seem a lot higher than current government annual inflation estimates of 3%. The worthlessness is alarming.

Fed Chairman Powell’s remarks reinforce the Fed’s mission of 2% inflation by restricting the economy.

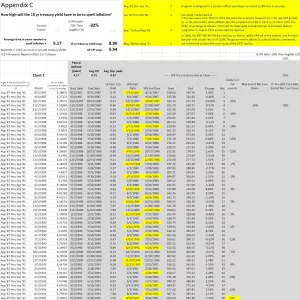

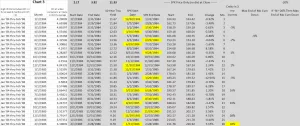

Yet the historical restriction has not yet landed. An inverted yield curve, of 10 year Treasuries paying 4.26% which is less than 6 month Treasuries paying 5.26%, historically means a recession is coming. In the following BOC methodology proprietary research, 3 out of 4 historic inflation environments experienced a recession.

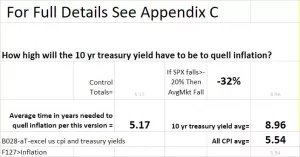

As shown in Appendix C

- in terms of interest rates, during those historic periods on average the 10 year US Treasury rose to 8.96%, as compared to 8/18/23 10 year Treasury yield of 4.26%.

- If the S&P 500 (symbol SPX) fell > 20%, the average stock market fall was -32%.

These are a lot of major risks. Like traveling the ocean, sometimes it’s better not being on the water. And there is another even greater risk.

Disintermediation risk strikes banks today.

Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase. According to CNBC on 8/8/2023 and 8/15/2023 Moody’s and or Fitch downgraded the following banks:

Ally Bank

Bank of America

Bank of New York Mellon

Bank OZK

BankUnited

BOK Financial

Cadence

Capital One

Cathay General

Citigroup

Citizens Financial Group

Columbia Banking System

Community Bank System

Cullen Frost Bankers

East West

Fifth Third Bancorp

First National of Nebraska

FNB Corporation

Fulton Financial

Goldman Sachs

Hilltop Holdings

Huntington Bancshares

JP Morgan Chase

M&T Bank

Morgan Stanley

Northern Trust Corporation

PacWest

Pinnacle Financial Partners

PNC

Regions

Simmons First National

State Street

State Street

Synovus Financial

The Bank of New York Mellon

Truist Financial

Trustmark

UMB Financial

US Bancorp

Webster Financial

Wells Fargo

Western Alliance

Wintrust Financial

We all remember the disintermediation risk that occurred in California when a major worldwide banker for startup equity firms almost collapsed overnight. Its disintermediation risk was quite apparent. The long term US Treasuries that Silicon Valley Bank (“SVB”) considered safe, if held to maturity, actually were unsafe as creditors stood in long lines wanting the bank to make good on huge deposits. Interest rates had risen so fast that the price of the long term US Treasuries caused an internal collapse of liquidity. When these Treasuries were marked to market because of a run on the bank, the bank had a highly leveraged negative net worth. The bank depositors had nothing to get because the bank was wiped out.

Over that weekend the Fed and the Secretary of the Treasury pledged to protect depositors across America without using taxpayer money. That added liability was so huge that it could only be covered, if necessary, by printing more currency. The US currency itself was at risk, or a banking falling dominoes effect would have occurred.

The US has a fiat currency. Fiat means backed by nothing but “full faith and credit” of the issuer of a currency.

The Fed restriction of the economy is designed to push down inflation largely by raising interest rates and reducing the amount of printed currency on the Fed’s balance sheet. Printed currency is slang for money amounts that have an arbitrary and questionable basis for existence, as opposed to a legitimate sum of paper currency and coins.

According to BOC Proprietary Research below, the US National Debt is funded by the sale of US Treasury debt offerings, 57% of which in 2023 have been funded with short term maturities under 1 year. The skew to short term and away from long term causes the disintermediation risk.

The disintermediation effect causes banks owning long term US Treasury debt offerings to experience significant bond price declines that are cutting into their reserves.

Battered bonds

On 8/17/2023 according to Bloomberg: “Yields on bonds across the globe jumped to the highest level since 2008 after minutes of the Federal Reserve’s last meeting showed policymakers remain worried about persistent inflation and signaled the possibility of further rate hikes. Signs of weakness in bond markets emerged worldwide… ‘The current selloff is being led by the longer end, underscoring concerns about supply and liquidity,’ said Prashant Newnaha, a macro strategist at TD Securities.”

If you consider the underlying problem any foreign government, any entity, and any person who owns long term US Treasuries faces disintermediation risk, if they need to sell their bonds before maturity.

Few want 30 year US Treasuries that yield 4.38% because of potential long term bond price declines. Short term treasuries yield over 5% with no long term potential price declines.

If you look at US Treasury debt offerings this year, our proprietary research shows 57% is short term. The disintermediation risk for the US Treasury is an inability to effectively fund long term debt offerings like the 30 year Treasury without wholesale disruption of the long term bond markets. That is why the short duration debt offerings abound in the 3 month category.

Bond buyers are waiting for rates to stabilize. Rates are in turmoil. So bond buyers go ultra short term. That is where the default risk comes into play. The high concentration of treasury debt offerings is 1 year or less. A healthier mix up to 30 years would include all maturities.

US corporates are better short term duration investments than US Treasuries because corporate America largely does not have disintermediation risk that the US Treasury now faces. The US Treasury is boxed into offering only what it can sell.

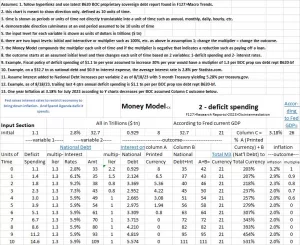

To understand this problem let us look into the BOC proprietary Money Model. It is worth examining closely.

On 8/18/2023, Units of time period 0, the US national debt of $32.7 trillion (“tn”), plus printed currency of $8 tn plus interest, results in a total of $42 tn that currently must be funded. For size comparison the amount of dollars in circulation in the world (M3) is $21 tn. If the $42 tn were paid off the amount of dollars in circulation would triple.

This directional only display is useful to understand directional outcomes in period 10, the US national debt of $109 tn, plus printed currency of $0 tn plus interest of $2 tn, results in a total of $111 tn that in period 10 must be funded. For size comparison the amount of dollars in circulation in the world (M3) is $21 tn. If the $111 tn were paid off the amount of dollars in circulation would rise to an alarming level 5 times greater at 531%.

If fiscal policy reversed to pay off US National Debt + Interest of $111 tn:

- a great recession may occur by consuming over 4 yrs of GDP at $26 tn/year

- a correlated collapse of all major asset classes may occur.

In the alternative

By Act of Congress, the currency could be revalued, old retired, and new declared. US National Debt would be paid off by printing more of the old currency. Starting over, the new currency would be issued like a reverse stock split 1 new for 5 old. Then the old currency would be retired. World wide everyone would give the old currency to the Fed for replacement. The Fed would destroy the old currency. A very messy process involving credit worthiness. A collapse of a money system is usually the result.

What other alternative could replace the old currency? Bitcoin is pure scarcity. Only 21 million may be issued. If a person ran for President on a platform of transacting in Bitcoin, the advanced economies around the world would be in chaos until they too did the same. In the interim worldwide chaos may ensue.

I had a professor in graduate school who was fond of saying 2 things. “The only thing man learns from history is that man does not learn from history,” and “No government has ever withstood the power of the printing press,” meaning printing currency.

After such a collapse, a person could run for President on the basis of pay as you go by removing the temptation above.

- Until there is nothing else to lose, Bitcoin still would offer the power to transact stably.

- Bitcoin is already set up.

Conclusion

The BOC feedback loop of back tested algorithmic results and ongoing refinements is essential to be “best of class” meaning top investor based on results 80th percentile or better.

Crucial to that is seeking to avoid unexpected losses, meaning a severe tendency to excess returns continuously. Getting out of problem areas quickly as they are encountered in the present is critical.

Long duration bond interest rates may not stabilize for several years before the Fed’s inflation target of 2% is reached. Until then ICSH may avoid further equity price drops. BOC recommends for all risk tolerances 100% in BlackRock Ultra Short-Term Bond ETF (symbol “ICSH”) with a 30 Day SEC Yield as of 8/17/2023 of 5.36%.

ICSH statistics indicate the 384 ultra short term holdings are turned over frequently.

- ICSH seeks to provide current income consistent with preservation of capital, according to BOC estimates with less than 39% in bank names of which 6% were rating downgraded, which is a risk. Paying off short term holdings is the highest priority for a corporation to retain its credit worthiness.

- Effective duration of ultra short term holdings is only 5.28 months actively managed for default risk by Blackrock Professionals.

- $46 million dollars in shares traded per day on average for the last 30 days.

- Expense Ratio: 0.08%

- 30 Day Median Bid/Ask Spread is 0.02%

- Distribution frequency monthly. Record Date: 8/2/2023; Ex Date 8/1/2023, and Payable Date 8/7/2023.

We rely on BlackRock’s cash management team to manage the bank risk portion of the short duration portfolio.

- Ultra short duration bonds from corporate America of 6 months or less tend to avoid long duration bond price risk and disintermediation risk of US Treasuries; yet keep capturing rising yields.

Most importantly, ICSH may avoid disintermediation risk of US Treasuries and may be a better place to hold cash than your bank, brokerage firm or any money market fund holding US Treasuries.

The other alternatives to avoid disintermediation risk of US Treasury securities include holding a stable AAA foreign currency, if one could be found as the world sovereign currencies have largely followed the US fiat model and have adopted their own Spend Agendas.

Spend Agenda is a phrase coined by BusinessOwnersCharter.com for recurring deficit spending. For example a US Fiscal Policy Spend Agenda has deficit spent every year since 2001. This Spend Agenda Special Report contends that to the degree that a persistent, dominant Spend Agenda recurs is the degree to which inflation may persist. Investment outperformance is a potential solution that may beat inflation.

To get your free trial copy of our BOC Newsletter, email Dan@BusinessOwnersCharter.com, or view our blog About the BOC Portfolio.

Our Research

Comes from the heart. We love what we are doing. Our passion is our investment methodology. The stock market is like the ocean never the same but rhyming. Rhyming patterns are what we seek.

We are statistical. Our methodology is based on back testing algorithms sequentially in market moods. 04 could be a symbol for a market mood. Algorithms are fitted to moods. There are many layers of sophistication that we add to our highly nuanced work. Outcomes over 5 or more years is our science. Repeated, duplicated processes work best over long periods of time. Be patient. Succeed. We invest in the same securities that our big data research offers up like treasures on the beach. Our hope is that you learn on our investing methodology journey over a lifetime.

Let’s see what we can deliver. We do not and cannot predict the future. We can only recommend the next right thing for now. Most of the time we do not exit the market. Most of the time we participate in the market. Our wholesale investment methodology offers a potential to provide outperformance of benchmark SPDR S&P 500 ETF Trust (symbol SPY).

Appendix C

End of Special Report

A research report by Newsletter Editor Emeritus, Jeff Liautaud. Jeffrey Liautaud (MBA, BS Mathematics) began his career on Wall Street in investment banking. In 2001, he founded Business Owners Charter, Inc. (“BOC”) for ownership of his proprietary investment management algorithms.

In 2008, Jeff provided a report entitled “The money isn’t there.” The report concluded:

“With respect to the 2008 bailout the money to fund $1.4 tn (trillion) dollars won’t be there, much less $9 tn to $16 tn dollars. If the money isn’t there and the government still wants its stimulus, the government has no choice except to print currency.”

And as predicted on 9/16/2009 printed currency on the US Federal Reserve (“Fed”) balance sheet was $1.4tn, which grew into $8.5tn by 7/30/2022.